In the world of strategic management, where companies juggle multiple products, business units, and investment decisions, the BCG Matrix stands out as a timeless and practical tool. Developed by the Boston Consulting Group in the 1970s, this matrix helps organizations visualize their product portfolio and decide where to invest, where to maintain, and where to divest.

Even decades later, the BCG Matrix remains relevant because of its simplicity—and its power to bring clarity to complex decisions.

What Is the BCG Matrix?

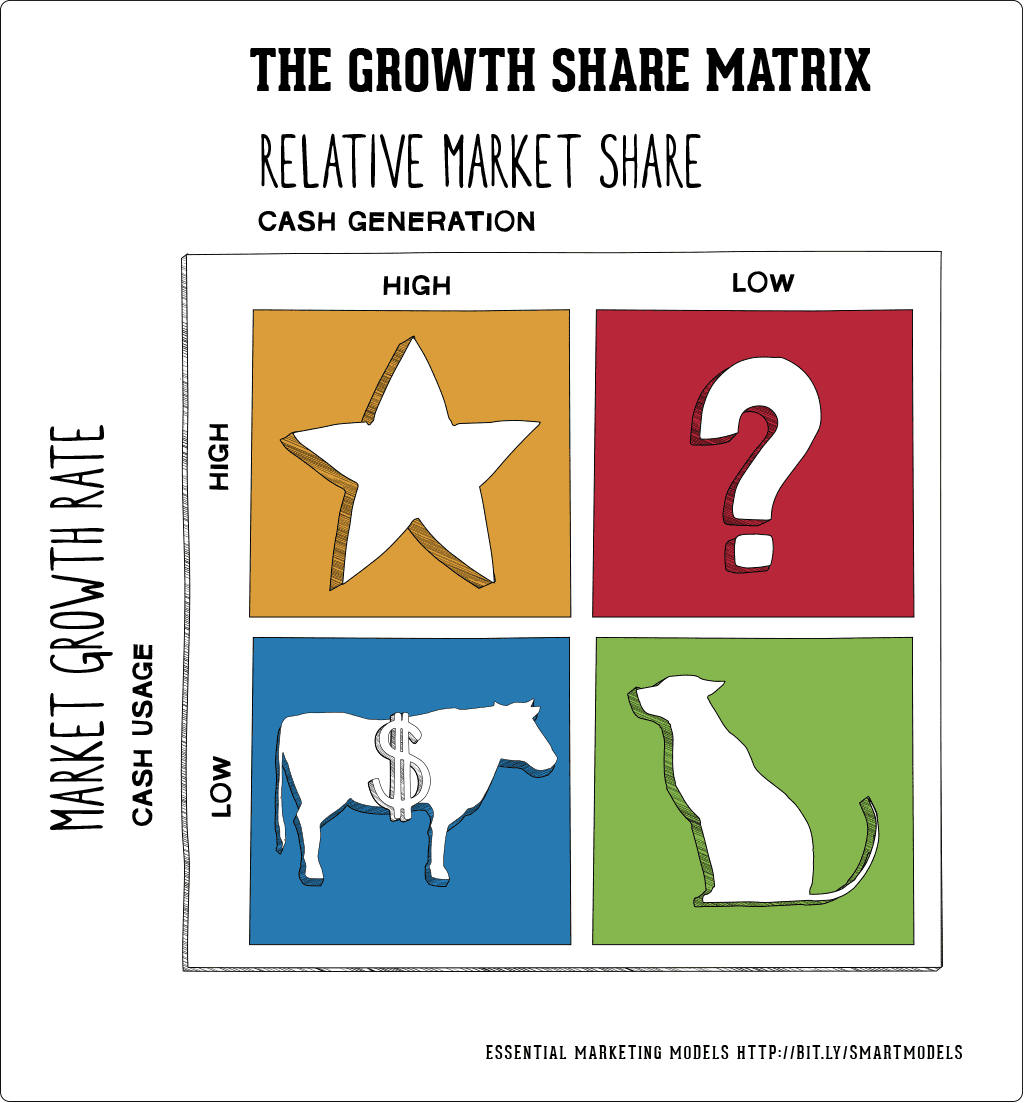

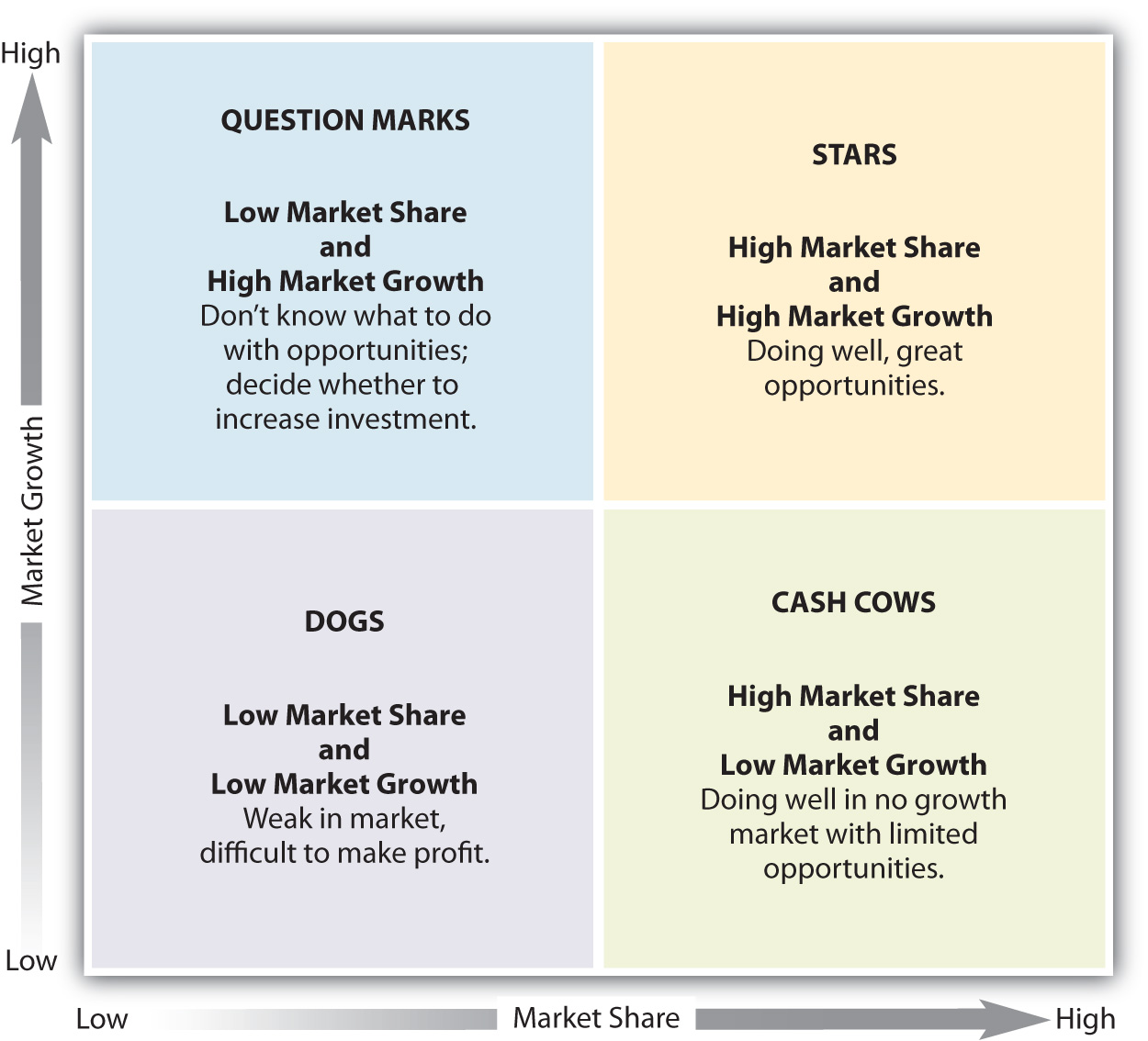

The BCG (Boston Consulting Group) Matrix, also known as the Growth–Share Matrix, classifies products or business units into four categories based on:

- Market Growth Rate (industry attractiveness)

- Relative Market Share (competitive strength)

By plotting these two variables, businesses can identify which products are worth scaling up, which need strategic support, and which may not be worth the investment anymore.

The Four Quadrants of the BCG Matrix

1. Stars: High Growth, High Market Share

Stars are the shining performers of the portfolio. They operate in fast-growing markets and hold a dominant market position.

Why they matter:

- Require significant investment to sustain growth

- Have the potential to become Cash Cows

- Drive brand visibility and long-term advantage

Example:

Apple’s iPhone in its early years—rapid market growth with strong market dominance.

2. Cash Cows: Low Growth, High Market Share

Cash Cows are stable, mature, and highly profitable products. They operate in slow-growing markets but enjoy a strong leadership position.

Why they matter:

- Generate consistent cash flow

- Require minimal investment

- Fund other business units (Stars & Question Marks)

Example:

Google Search—a dominant product in a stable market, funding several of Google’s new ventures.

3. Question Marks: High Growth, Low Market Share

Question Marks (also called Problem Children) are present in fast-growing markets but lack market dominance.

Why they matter:

- Potential to become Stars or Dogs

- Need heavy investment and strategic decisions

- Often the most uncertain quadrant

Example:

Electric cars for many traditional automakers when the market was still emerging.

4. Dogs: Low Growth, Low Market Share

Dogs are products with weak performance in slow-moving markets.

Why they matter:

- Generate marginal returns

- Often candidates for divestment

- Can be retained if they serve niche or strategic purposes

Example:

Legacy tech gadgets like MP3 players that no longer have a profitable market.

How the BCG Matrix Helps in Portfolio Management

1. Strategic Investment Decisions

Managers can allocate resources more effectively by understanding which products deserve funding and which don’t.

2. Balancing Risk and Returns

A balanced portfolio ideally contains:

- A few Stars for growth

- Several Cash Cows for stability

- Carefully chosen Question Marks for future bets

- Minimal or strategic Dogs

3. Long-Term Sustainability

By regularly updating the matrix, businesses ensure their resources are aligned with changing market dynamics.

4. Simplified Communication

The matrix visually communicates complex portfolio insights, making it easier for leaders and stakeholders to make aligned decisions.

Steps to Build a BCG Matrix for Your Business

1. List Your Products or Business Units

Identify all offerings in the portfolio.

2. Measure Market Growth Rate

Use industry reports, competitor analysis, or internal data to assess annual growth.

3. Determine Relative Market Share

Compare your share with the largest competitor.

4. Plot Your Products on the Matrix

Place them in the appropriate quadrant.

5. Define Strategies for Each Quadrant

- Stars → Invest & grow

- Cash Cows → Maximize profits

- Question Marks → Selectively invest or divest

- Dogs → Harvest or discontinue

Real-World Example: BCG Matrix for a Tech Company

Let’s imagine a tech company with four key products:

| Product | Category | BCG Quadrant |

|---|---|---|

| A – Flagship Smartphone | High growth, high share | ⭐ Star |

| B – Laptop Series | Low growth, high share | 💰 Cash Cow |

| C – Smart Home Devices | High growth, low share | ❓ Question Mark |

| D – MP3 Player | Low growth, low share | 🐶 Dog |

Strategic Insight:

Use profits from Product B (Cash Cow) to invest in Product A and C while considering phasing out Product D.

Limitations of the BCG Matrix

While useful, the BCG Matrix has its constraints:

- Oversimplifies a complex market

- Assumes market share always correlates with profitability

- Ignores synergies between business units

- Doesn’t consider external factors like regulation or innovation

Despite these limitations, it remains a starting point for many strategic discussions.

Conclusion: Why the BCG Matrix Still Matters

The BCG Matrix empowers leaders to take a structured approach to portfolio management. Its simplicity makes it accessible, while its insights help companies build profitable, future-ready portfolios.

In a competitive marketplace, understanding where to focus your resources can make the difference between growth and stagnation—and the BCG Matrix ensures you make those decisions wisely.

Leave a Reply